To show how wealthy corporations would be held accountable by a tax proposal she released late last month, Sen. Elizabeth Warren on Thursday put out a report illustrating the unfair “free ride” powerful companies have gotten for years—and doubled down on her demand that Democrats pass the Build Back Better Act, which includes a new corporate profits tax to level the playing field and raise money to invest in anti-poverty and climate action programs.

In her report, titled “Tax Dodgers: How Billionaire Corporations Avoid Paying Taxes and How to Fix It,” the Massachusetts Democrat shows how 70 of the richest corporations in the U.S. “have rigged the tax code in their favor, employing armies of lobbyists and accountants to write and abuse the rules so they can avoid paying their fair share of taxes.”

In the report and on social media, the senator called out corporations including FedEx and DISH, which paid $483 million in taxes last year—a 7.2% tax rate—and $0 in taxes, respectively. DISH also collected a $223 million tax refund from the federal government despite raking in $2.6 billion in profits in 2020.

“Does that sound fair to you?” Warren asked.

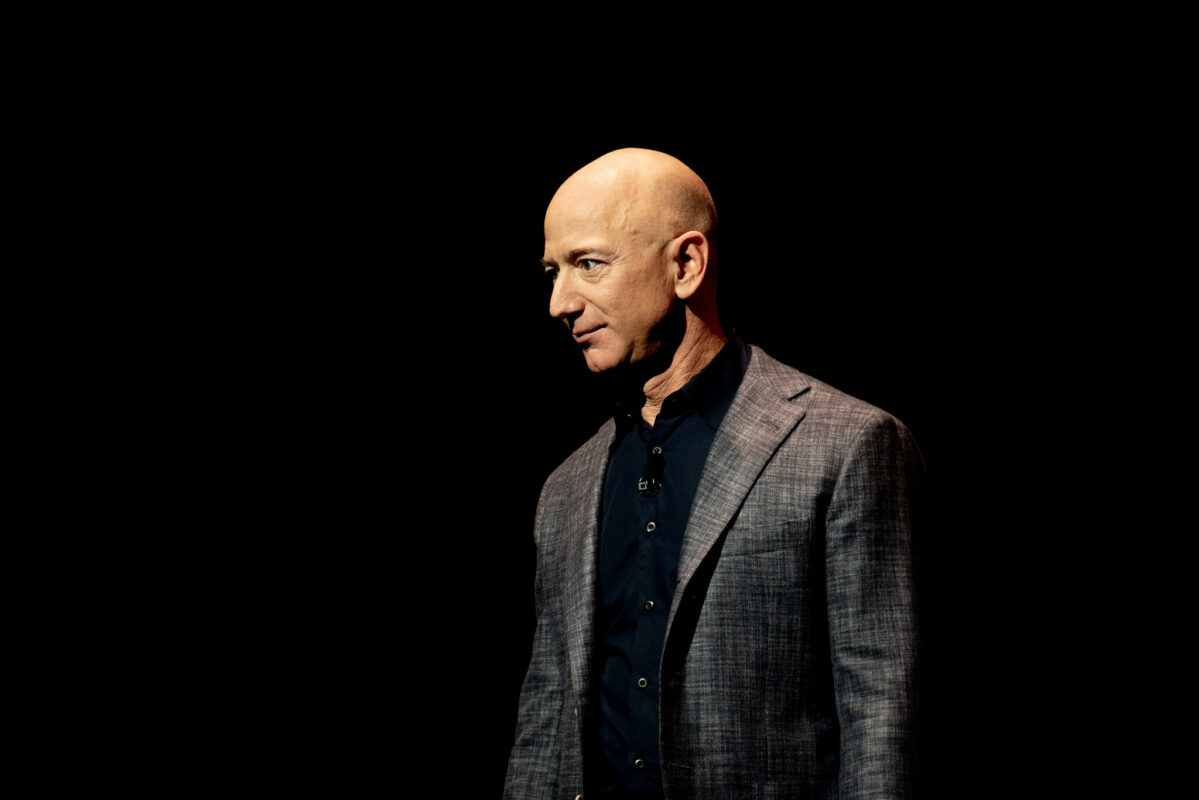

According to the report—which is based on data Warren’s staff compiled from the Institute on Taxation and Economic Policy—although Amazon paid $2.8 billion in federal and foreign income taxes in 2020, its effective tax rate was just 11.5% on global profits totaling $24.3 billion, while the company handed out $118 million in executive compensation.

The rigging of the tax code and wealth inequality have worsened in recent years following the passage of the Tax Cuts and Jobs Act of 2017 by former President Donald Trump and the Republican Party—a trend that Warren and her colleagues Sens. Ron Wyden (D-Ore.) and Angus King (I-Maine) hope to reverse with the Corporate Profits Minimum Tax (CPMT), which they proposed in October as a way of generating revenue to support the Build Back Better Act.

“It’s time to stop letting giant corporations cheat the system—they should pay taxes just like everyone else,” said Warren. “My Corporate Profits Minimum Tax would help put an end to tax-rigging schemes and raise billions in revenue so we can make real investments in American families.”

As Common Dreams reported last month, the CPMT would require corporations to pay at least a 15 percent tax rate if they report more than $1 billion in profits to shareholders—applying to about 200 U.S. companies.

Under the CPMT, Warren’s report shows, in 2020, “Amazon would have paid $3.6 billion in total U.S. federal and foreign income taxes, providing up to $836 million more in revenue for key priorities for American families.”

According to the report, the CPMT, which is supported by 70 percent of Americans, would generate nearly $320 billion in revenue. The 70 companies highlighted in “Tax Dodgers” could have contributed $22 billion in 2020 alone.

Instead, Warren said Thursday, “while these companies report billions in profits, they often pay no income tax to the IRS and leave hardworking families holding the bag.”

As former Maryland Gov. Parris Glendening wrote in The Hill on Thursday, the CPMT “would also put the United States in line with much of the international community, specifically with the Group of 20 which is formally endorsing a new global minimum tax of 15 percent to reverse the decades-long decline in tax rates on corporations across the world.”

Warren’s report was released as Democrats await the Congressional Budget Office’s (CBO) announcement, expected late Thursday, regarding the total cost of the Build Back Better Act. Right-wing Democrats in Congress have claimed they want to see the CBO’s score of the package before approving it. House Speaker Nancy Pelosi (D-Calif.) said Thursday the House will vote on the $1.75 trillion 10-year investment in anti-poverty measures and climate action as soon as the score is released.